Always Get the Best Loan for Your Business

Review top lender offers through our service and receive lower rates, longer term lengths, and the right structure for your business. Access the best options available without the hassle.

- Serving All Industries Nationwide

- Dedicated Funding Experts

- No Cost. No Obligation.

- 100% B2B. No Personal Credit Reporting

Medical Practice

Dallas, TX

$250,000

Construction

Phoenix, AZ

$75,000

Restaurant

Miami, FL

$30,000

Hotel/Motel

Las Vegas, NV

$650,000

Retail

Dallas, TX

$75,000

Wholesale & Distribution

Chicago, IL

$200,000

CPA & Legal

New York, NY

$100,000

MedSpa

Los Angeles, CA

$75,000

Livestock & Farming

Des Moines, IA

$150,000

Manufacturing

Detroit, MI

$500,000

8,200+

Satisfied Clients

$10,000,000

Max Loan Amount

24 hr

Processed Within

Here’s How It Works Fast, Transparent, and Built for Your Business

Apply & Upload Statements

Start with a simple online application and securely upload your recent business bank statements for a fast review.

Speak With a Funding Specialist

We’ll walk you through available offers, no cost, no obligation, and help you understand what fits best for your goals.

Receive Funds Within 24 Hours

Once you’re approved and fully informed about your offer, funding is typically deposited within 24 hours.

Have Questions Before You Apply?

You’re not alone. Here are answers to some of the most common questions business owners ask before getting started:

How Much Can I Get?

You may qualify for up to 35% of your annual revenue, depending on your business profile. While funding amounts vary, speaking with a Funding Specialist gives you a personalized estimate based on factors like time in business, cash flow, and more.

Expert Guidance:

Expert Guidance: We request 3 months of recent business bank statements and an online application. These give us a real snapshot of your business performance, especially cash flow, which is the number one driver of approvals. Other factors like business credit, personal credit, liens, or judgments are considered but not deal-breakers.

What Will It Cost Me?:

Costs vary depending on your business profile and underwriting. The good news is that our Funding Specialists help you understand what to expect, explain the pricing structure in plain English, and guide you toward the most affordable options. Many returning clients qualify for 0% origination fees.

Should I Talk to Someone or Just Apply?

If you want to talk it through, schedule a quick call with a Funding Specialist. Want to skip the line and get your file in for review? Apply now and upload your bank statements. 90% of businesses that do this see same-day offers from our nationwide lender network.

Smart Capital. Year After Year.

Working Capital

Fast term loans fueled by your recent cash flow, time in business, and credit strength available to every industry. Get approved and funded in as little as 24 hours.

Equipment Financing

Secure up to a 72-month term loan to purchase revenue-generating equipment today and start earning ROI right away without tying up your working capital.

Line of Credit

Access up to $10,000,000 for 36 months with no pre-payment penalties. Draw only what you need, when you need it, and pay interest solely on the funds in use.

24 hr

Processed Within

$10,000,000

Max Loan Amount

8,200+

Satisfied Clients

When Payments Slow Down, Your Business Shouldn’t.

We help small businesses access fast business funding and other flexible financing solutions when cash flow slows, invoices are delayed, or banks say no.

Through our network of private business lenders in the USA, we connect you with flexible small business funding options, including same-day business funding programs designed to keep your operations running smoothly without reporting to personal credit or adding visible debt.

Apply online in just 2 minutes and get matched with the right business loans for small business needs.

Same-Day Approvals Up to $10,000,000

Access fast, flexible funding options nationwide through our network of trusted lenders who understand small business needs.

To qualify, your business should be at least one year old and earn a minimum of $300,000 annually or $25,000 per month over the last three months.

Get matched with small business funding programs designed to help you grow without long delays or complicated paperwork.

Explore Your Business Funding Potential

Offers are based on your revenue, business credit, and time in operation. No cost. No obligation. No personal credit reporting

My Credit Is...

Projected Annual Revenue This Year:

How Much Could My Business Qualify For?

See How Much Your Business Qualifies For 100% B2B Loan Offers. Self-apply to get approved up to 90% faster.

No cost. No obligation. No personal credit reporting - ever.

Stay Up to date By Subscribing To Our Newsletter

Read some of the testimonials of our satisfied clients

They helped us get $400K in funding across 4 restaurants no collateral, no personal credit reporting.

Mark R.

General Contractor – Dallas, TX

We grew our credit line from $75K to $300K and now bid on bigger jobs with zero stress.

Nina L.

Boutique Hotel Owner – Charleston, SC

No personal credit reporting just the flexible capital we needed for renovations and staffing.

Sandra P

Multi-Location Restaurant Owner – Atlanta, GA

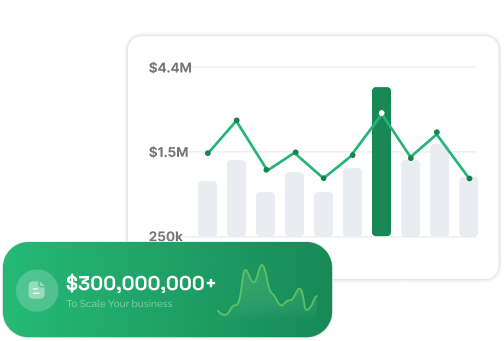

Over $300,000,000+ Funded Nationwide — Let’s Add Your Story

Your journey towards achieving your business aspirations backed by a reliable financial partner is just a call or click away. Let’s build your success story together.